Click here to download article as a PDF

Click here to download article as a PDF

To many, Yale endowment’s former CIO David Swenson (1954-2021) was one of the most influential investors of our time. Under his leadership, the Yale endowment pioneered an approach to investing that produced tremendous results and, ultimately, revolutionized the way institutions allocate capital.

Over his 36 years at Yale, Swensen directed the endowment to invest heavily in alternative assets rather than traditional assets (stock and bonds). His largest allocations were to private equity and venture capital, where he felt markets were less efficient and investors could generate significant excess returns.

His theory proved correct. Yale was able to make significantly higher returns than other endowments and generated billions of dollars of value for the school. Eventually, the approach pioneered by Yale came to be known as the ‘Endowment Model’ and it has since been widely adopted by endowments, family offices and other institutional investors around the world.

But does the Endowment Model for investing make sense for private investors? More specifically, how much should we allocate to private equity vs. other asset classes?

The Case for Private Equity

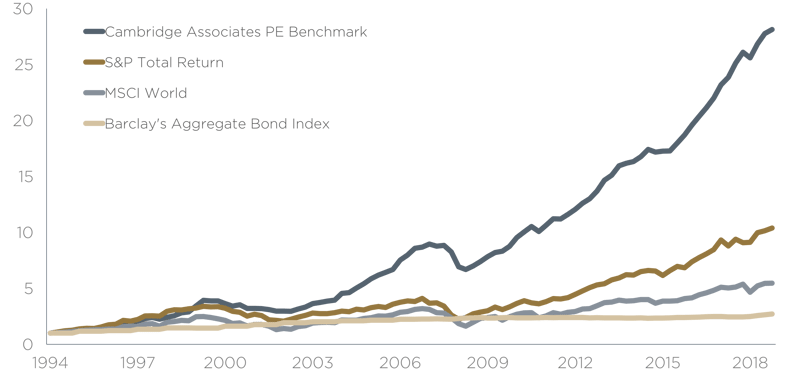

Source: Insead, Re-Thinking Private Equity Risk and Reward for LP Allocations

There are a number of compelling reasons why institutions have followed Yale’s lead and invested heavily in private equity.

Over the past thirty years, private equity has consistently and materially outperformed public equity and other asset classes. Indeed, for Yale, private equity and venture capital have been their top-performing strategies. In addition, private equity exhibits much lower volatility than public equity or other liquid strategies.

Also, as the private equity industry has grown and matured, many companies are opting to simply stay private. Why bother with the increasing costs and regulations, as well as the constant scrutiny of being listed on a stock exchange, when you can easily access significant capital from long-term oriented investors? Institutions have come to realize that they need to invest in private equity to access many of the world’s most attractive and exciting companies.

Too much of a “good thing”?

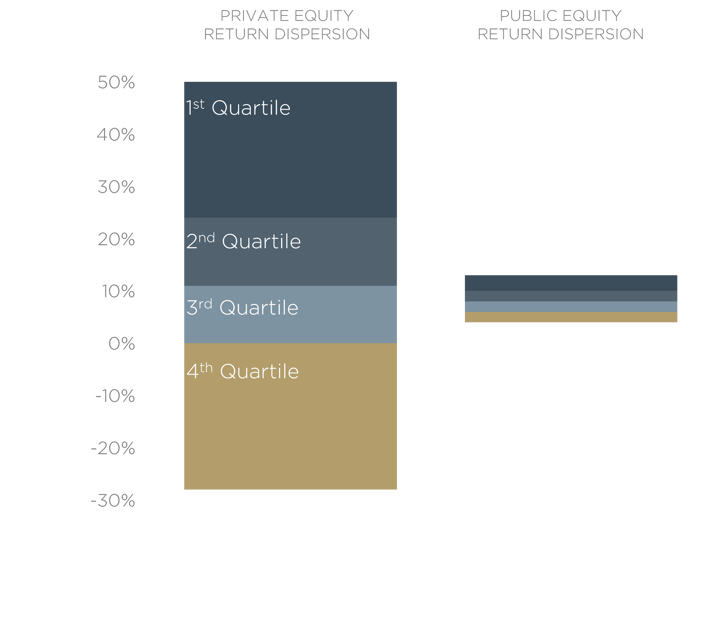

There is, however, no guarantee that this outperformance will continue. And while average PE fund returns have been strong, individual fund returns have varied widely. In other words, the risk and cost of underperformance in private equity is very high.

Source: McKinsey. 5-year annual returns for US private equity and public equity by performance percentile, 2013-2018

While diversification can mitigate the risk of underperformance, private equity is still an illiquid and

long-dated asset class. If an investor allocates too much to private equity, they risk finding themselves facing a liquidity crunch. During periods of market dislocations and distress, it is not uncommon for institutions to be forced to sell high quality private equity funds to secondary buyers, often at significant discounts, in order to free up cash. Private equity investors want to be capturing an ‘illiquidity premium’, not paying it to other investors.

How Much PE Do You Really Want?

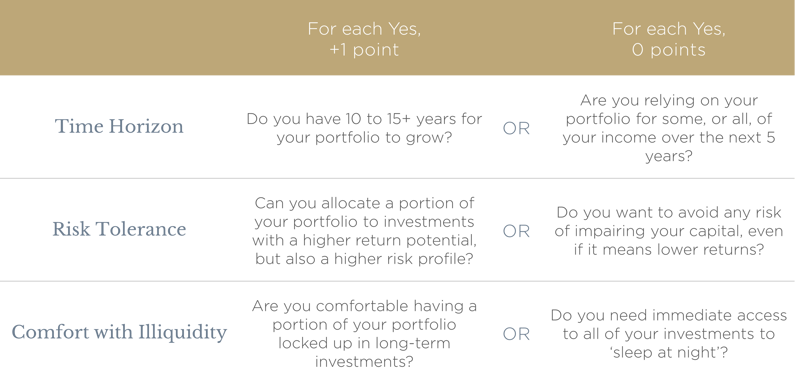

When determining the appropriate asset allocation, investors should ask themselves some fundamental questions.

We have devised a simple (albeit unscientific) test to help investors determine how much private equity exposure they should have in their portfolio. The main objective is to better understand one’s objectives and sensitivities. Please ask yourself these questions and tally your score.

The test presumes that you have access to institutional quality private equity investments and sufficient capital to build diversified exposure.

Should you invest like an endowment?

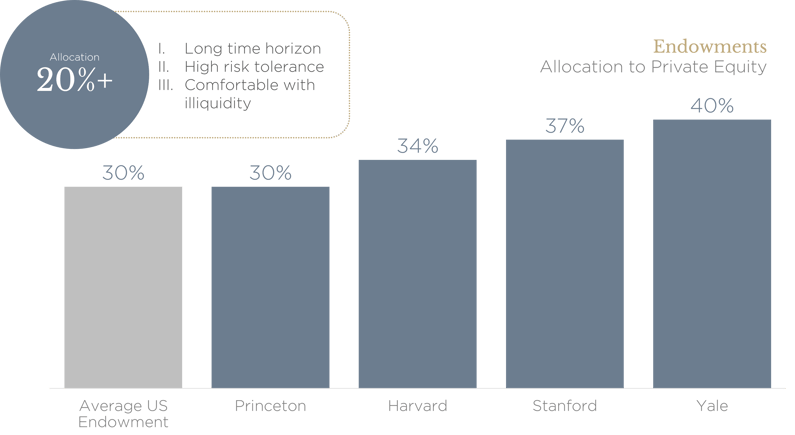

If you scored 3 on the self-assessment questions, you may want to emulate how endowments invest.

Endowments tend to have very long time horizons and many have been investing in private equity for decades. Furthermore, in addition to their investment returns, universities often have multiple ongoing streams of revenue to support operations, such as tuition, donations, broadcast rights for sports teams, etc. These factors can give endowments the ability, and comfort level, to allocate a sizeable portion of their portfolio to private equity.

While capital preservation is important to all investors, endowments often prioritize maximizing long-term growth over other considerations.

Source: 2022 NACUBO-TIAA Study of Endowments, 2022 Annual Reports

Or should you invest like a pension?

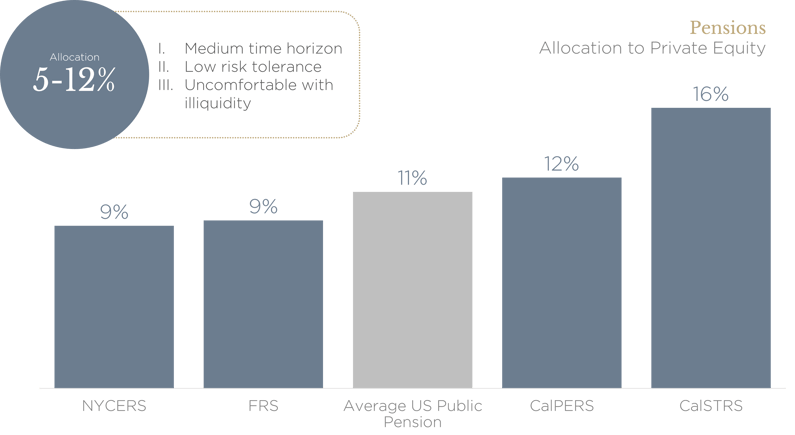

If you scored 2 or lower on the self-assessment questions, you may want to emulate how pensions

invest.

Pensions have very different needs and objectives from endowments. Depending on the average age of its members, a defined benefit pension may be more focused on providing income to pensioners today; or being able to provide income to pensioners in the future. Most are somewhere in the middle, with a blended medium-term time horizon. Consequently, they must balance the competing objectives of growth and safety.

It is, therefore, not surprising that these investors tend to have much smaller allocations to private equity compared to endowments.

Source: Investment Council, 2022 Annual Reports

Source: Investment Council, 2022 Annual Reports

We can learn a lot from successful institutional investors, like the Yale endowment, that have invested their portfolios across multiple asset classes for decades. It is clear that private equity is an attractive and important asset class, given its ability to offer greater diversification and enhanced returns. However, it is also a risky and illiquid asset class, so a large allocation to PE may not make sense for everyone’s portfolio. The key to determining an appropriate allocation to the asset class

lies in reflecting on one’s own personal circumstances and investment objectives.

Speak with our team to learn how Overbay can provide high quality, diversified private equity exposure, suited to each investor’s individual ideal asset allocation.

Click here to subscribe to get our insights delivered to your inbox regularly. Our goal is to make you a smarter private equity investor.